Get a consolidated view of your BMO and non-BMO financial information with a personalized command center.

Enjoy a truly rewarding credit card.

Get 15,000 bonus points when you spend $1,500 within 3 months of opening your account. footnote 1

Received a credit card offer in the mail? Apply now

Apply and get a response in 60 seconds or less.

Your card offers a wide range of benefits, from cellphone protection to reliable roadside assistance.

Receive up to $400 in coverage when using your BMO Platinum Rewards Credit Card to pay your monthly cell phone bill footnote 3

We will double the original manufacturer’s (or U.S. store brand) warranty for up to an additional 12 months of coverage on most new items footnote 4

With Master RoadAssist® Roadside Service, get help with jump-starts, tire changes, towing and even gas delivery, whenever you need it. footnote 4

Annual FeeFootnote star

Variable purchase APRFootnote star

19.49% to 27.49%,

based on your creditworthiness

Balance transfer APRFootnote star

0% introductory APR footnote 5 on balance transfers for 12 months from date of first transfer when transfers are completed within 90 days from date of account opening. After that, a variable APR applies, currently 19.49% - 27.49%, based on your creditworthiness.

Earn BMO Flex Rewards points every time you spend and rack up the rewards.

Includes 15,000 welcome bonus footnote 1 and first year Anniversary bonus. footnote 2

Gas, EV charging and grocery purchases (earn 2 points for every Dollar1 spent footnote dagger):

All other eligible purchases (earn 1 point for every dollar sign1 spent):

footnote dagger details Up to 1500 dollars in gas, EV charging, and grocery purchases each calendar quarter and one times on all purchases after that.

Discover a new way to pay smarter. Break eligible purchases into more manageable payments with a fixed monthly fee footnote 6

Check your balance, pay your bills and track your spending all in one place and make the most of your credit card by taking advantage of special features and money management tools.

Get a consolidated view of your BMO and non-BMO financial information with a personalized command center.

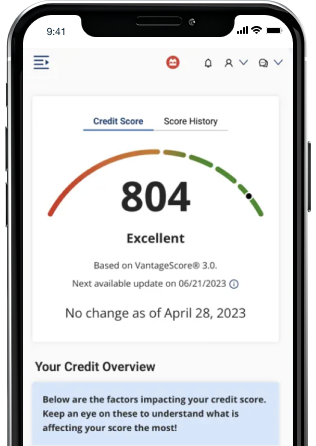

Get no-fee, no-impact access to your credit score.

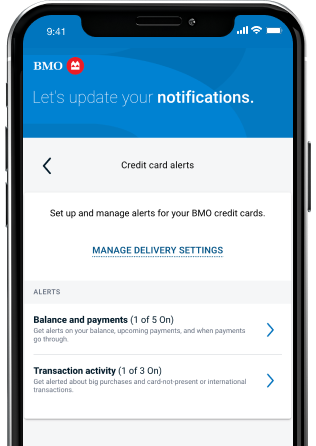

Track spending, receive real-time updates, and manage your card with custom alerts and notifications — all in one place.

Once you've received your card, just give us a call to activate it.

If you have a BMO Platinum Credit Card, a BMO Platinum Rewards Credit Card, BMO Boost Secured Credit Card or a BMO Cash Back Credit Card, call 1-855-825-9237.

If you have a BMO Premium Rewards Credit Card or a BMO Escape Credit Card call 1-855-825-9238.

It’s easy! For every eligible dollar you charge to your BMO Platinum Rewards Credit Card, you automatically earn points. Charges that are eligible for points include, but are not limited to, airline, restaurant, hotel, car rental, service station, mail and online orders and retail purchases. Payments and cash advances are ineligible for points accrual. Learn more about how the BMO Flex Rewards Program works.

No, your BMO Flex Rewards points will not expire as long as your account is open and in Good Standing. Good Standing means that your account is not canceled, past due or otherwise in default under the terms of an Agreement you have with us. Find out more about the BMO Flex Rewards Program Rules.

Great question. You can transfer balances from other credit card accounts to your new BMO credit card account. Please note that you can’t transfer balances from other accounts you have with us. Balance Transfers accrue interest from the date of transaction without a grace period.

Can’t find your card? No worries, we’ve got you covered.

If you’ve misplaced your card or suspect that it’s been stolen, just let us know. Visit the Lost and Stolen Credit Card Page to learn more.

Footnote 1 details Participation in BMO Flex Rewards is subject to terms and conditions found in BMO Flex Rewards Program Rules, available at: bmo.com/bmoflexrewardsconsumer. The Account must be current and in good standing to accrue and redeem points or cash back, as applicable. While points and cash back don’t expire, if the Account is closed for any reason, the Account will no longer be able to accrue points or cash back. All accrued points or cash back not redeemed will be available for redemption for 90 days as long as the Account is closed in good standing. All cash back is redeemable in the form of a statement credit. The introductory rewards bonus is based on total net qualified purchases made in the first three months of account opening and rewards will be awarded to qualifying Accounts 3 - 4 weeks after the conclusion of the three month period.

Footnote 2 details Anniversary Bonus is based on net purchases made in the year prior to Anniversary Date. Please see the Program Rules for more information about the Anniversary Bonus.

Footnote 3 details Coverage provided under a group insurance policy issued by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage only. Coverage for a stolen or damaged eligible cellular wireless telephone is subject to terms, conditions, exclusions, and limits of liability of this benefit. The maximum liability is $400 per claim for BMO Platinum Rewards Credit Card, and $600 per covered card per 12-month period. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per covered card per 12-month period. The monthly bill associated with the phone must be paid with the eligible card for coverage to be effective. Refer to the Mastercard Guide to Benefits for more information.

Footnote 4 details Certain terms, conditions, and exclusions apply. Extended Warranty, Master RoadAssist® and MasterRental® are underwritten by New Hampshire Insurance Company, an AIG company. For complete coverage terms and conditions call 1-800-MASTERCARD (1-800-627-8372) for assistance. Refer to the Mastercard Guide to Benefits for more information.

Footnote 5 details You can request to transfer balances from credit card accounts that you have with other credit card issuers. By submitting your Balance Transfer request you agree that the terms and conditions of your Cardholder Agreement apply to all balances transferred. Please refer to the Summary of Credit Terms for important information about rates and fees.

Footnote 6 details BMO PaySmart installment plans allow cardholders to repay specific eligible purchases in equal monthly payments over a defined repayment schedule. When you create a PaySmart Plan, it will be subject to a fixed monthly fee of up to 1%. The exact fee will be based on the purchase amount and the duration of the plan, which will be disclosed when the plan is created. The monthly plan fee will remain the same until the PaySmart Plan is paid in full. Review the Terms and Conditions.

Footnote 7 details Certain terms, conditions, and exclusions apply. Call 1-800-Mastercard for assistance. Additional details are provided in the BMO Mastercard Guide to Benefits for more information.

Footnote 8 details Pay only for purchases that you have authorized on your Mastercard card. Unauthorized purchases are not your responsibility. Conditions and exceptions apply. Learn more at http://www.mastercard.us/zero-liability.html.

Footnote 9 details CreditView and its features, Score Simulator and Credit Education, are provided by TransUnion® for educational purposes only. You should consult with your own financial team for more information about credit score.

footnote star details Summary of Credit Terms for rate and fee information.

Apple and Apple Pay® are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Pay are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks of Samsung Electronics Co., Ltd. Use only in accordance with law. Other company and product names mentioned may be trademarks or their respective owners.

Mastercard, the Mastercard Brand Mark, Mastercard® ID Theft Protectiontrademark, Master RoadAssist®, MasterRental®, and the circles design are trademarks of Mastercard International Incorporated.