Wealth solutions to fit every stage of your life

From building wealth to preparing for your future, our wealth solutions are designed to evolve with you.

- Tailored

Insightful and carefully crafted solutions that align with your unique needs and values.

- Insightful

Forward-thinking solutions for today, designed with your future in mind.

- Comprehensive

Solving multiple complex needs through one authentic relationship.

What does wealth planning include?

Managing your wealth requires a delicate balance between meeting your current financial planning and liquidity needs and preparing for the future.

At the heart of your wealth plan is our discovery conversations. We’ll work with you to understand your investment risk tolerance, the right asset allocation for you, and your long-term wealth goals. Your goals and needs drive all our investment decisions. Our comprehensive and strategic approach to wealth planning can help address all areas of your finances, including, but not limited to:

Risk management

Business succession

Investment management

Tax-optimization goals

Philanthropic objectives

Retirement planning

Education planning

Insurance needs

Estate and trust planning

How we help create your financial planning blueprint

Whether you have recently acquired wealth or you’re looking for a different perspective on how to manage the wealth you’ve accumulated, a detailed wealth plan can provide a comprehensive overview of your current financial situation and map out how you can achieve your unique goals and objectives down the road.

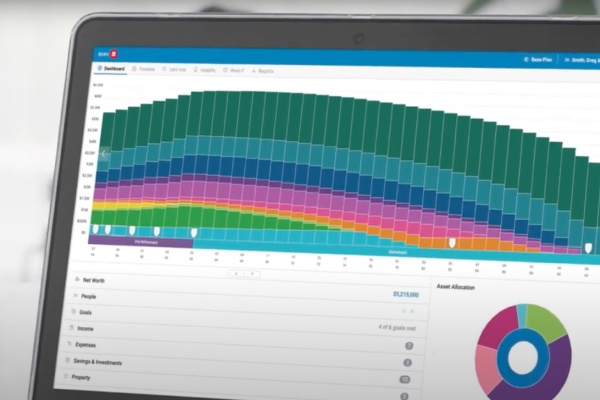

Wealth planning with our digital tool: BMO WealthPath®

Your BMO Private Wealth professional will devise a bespoke plan using our digital wealth planning tool, BMO WealthPath®. You’ll be able to view your plan online and see how different “what-if” scenarios may impact your financial plan and help you feel more connected to your finances. If your personal situation changes and you want to incorporate a change in your plan, please speak with your BMO Private Wealth professional.

Start the conversation

Answer a few questions about your wealth planning needs, and one of our BMO Private Wealth professionals will reach out.

About our BMO Private Wealth professionals

At BMO Private Wealth, we have a team of dedicated professionals with different areas of expertise, from estate matters to trusts to high-net-worth planning. We’ll match you with the professional who is the best fit for you based on your needs and your situation. And, as your needs change, we’ll connect you with the right BMO wealth planning specialist who is best suited to help you.

Commonly asked questions

Start the conversation

Connect with a BMO Private Wealth professional about your needs.